Got Your Tax Return? Invest in Home Improvement!

Every year, Canadians across the country have the opportunity to use their tax returns for making improvements to their home. The amount of money you receive may differ from one person to another, but investing in some form of home improvement can be worth it in a major way.

It’s essential for you as a homeowner to understand what kind of investments are possible with your tax return, from major renovations down to minor projects, such as redecorating or landscaping. Regardless of how much money has been allocated, there are plenty of clever solutions that can help enhance your living space without exceeding your budget limits.

Environmental Benefits of Home Improvement

With a new fiscal year comes additional incentives and deductions for those wanting to increase the value of their homes. However, one aspect that is often overlooked when considering these investments is sustainability. Investing in new windows can be beneficial not only from an aesthetic perspective, but also from an environmental standpoint.

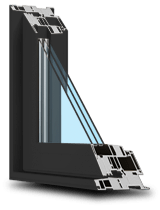

New window technology this year has advanced significantly, providing homeowners with greater energy efficiency capabilities than ever before. By investing in upgraded windows, households can reduce their heating and cooling costs while simultaneously reducing carbon emissions into our atmosphere.

This form of sustainable home improvement will not only help protect our environment, but has the potential to contribute to increased property values for your home as well.

Investing in Sustainable Home Improvement by Upgrading Your Windows

It's tax season in Canada, and that means one thing: an incredible opportunity for home improvement.

Canada’s Home Renovation Tax Credit provides Canadian homeowners with the perfect chance to make their homes more energy-efficient without blowing their budget - plus, you can use all the savings from your taxes to upgrade your windows – a wise investment that will not only add value to your property, but also provide numerous benefits, such as better insulation, increased security, enhanced comfort, and even lower heating costs. With this credit in place, getting quality windows at an affordable price has never been easier!

Furthermore, when done correctly, window replacement also ensures protection against wind-driven rains and other external weather elements which could potentially damage your interior walls or furniture.

How to Make the Most of Your Tax Return by Investing in Home Improvement

A recent study conducted by Trulia found that up to 94% of homeowners think that making improvements to their homes adds value to their property and increases its overall worth – and investing in sustainable home improvement projects, such as upgrading windows, is one such example.

Upgrading old or inefficient windows can not only help you increase the energy efficiency of your home, but can also help you maintain indoor temperatures more effectively year-round. Additionally, these types of upgrades will help reduce your heating and cooling costs over time, allowing for greater savings on household bills down the line.

When done correctly, investments made in improving your home now can pay off exponentially in both financial and aesthetic terms later on. This makes it even more important for individuals looking to invest their tax returns wisely to consider how best they can make use of them when considering any kind of home improvement project.

Can I Claim Home Renovations On My Taxes?

For many Canadians wondering if they can apply home improvements to their income taxes, the answer may be complicated, but full of possibilities.

The government has provided a tax credit, known as the Ontario Home Renovation Tax Credit (OHRTC), which offers up to $10,000 in eligible expenses that could lead to savings when filing income taxes. It is crucial, however, for filers to meet all criteria specified by both federal and provincial/territorial regulations prior to claiming any deductions or credits related to their home renovation projects.

What Is the Home Improvement Tax Credit for 2023?

The Home Improvement Tax Credit for 2023 presents an excellent opportunity for homeowners to gain a non-refundable 15% tax credit on up to $3,000 of qualified expenses. Eligible projects include the installation or replacement of windows, doors, insulation, and water heaters that have been paid for between February 24th, 2020 and January 1st, 2021.

Your home must also have been owned by or occupied by the individual claiming the credit during this period in order to be eligible.

When filing your taxes, it is important for homeowners to understand all applicable requirements related to claiming this tax credit, including submitting an application form with proof of payment attached, as well as not having received any other financial assistance from another government program relating directly to their project.

Additionally, meeting eligibility criteria outlined by Canada Revenue Agency (CRA) will ensure homeowners can maximize their ability to take advantage of this beneficial incentive when filing taxes.

What House Expenses Are Tax Deductive in Canada?

When it comes to taxes, knowing what expenses are tax deductible can be the difference between an overflowing bank account or one that's barely scraping by. In Canada, there are various home-related expenses that qualify for a deduction on your taxes.

Homeowners who have spent money on repairs, maintenance, renovations, or improvements may be eligible for deductions depending on when these costs were incurred. Repairs made within the same year as filing can usually be deducted in full, while any improvement projects with an expected life of more than one year should be split over several years, according to the depreciation rate associated with them.

As tax season draws to a close, Canadian homeowners are looking for ways to make the most of their hard-earned money, and home improvement is an excellent option for those seeking a secure and cost-effective investment - not only does it add value to your property, but certain upgrades may also qualify you for deductions on your taxes.

For instance, replacing windows can reduce heating costs while simultaneously increasing the market worth of your home - meaning that not only will you save money in the short term, but you will also reap long-term benefits as well!

Whatever changes you decide on, making sure they're eligible for deductions should be at the forefront of your mind - this way, any renovations or improvements made can help offset some of your associated costs come tax time.

At Canadian Choice Windows & Doors, our team is here to help you navigate your home improvement projects and plans with clarity and efficiency, making sure you’re able to make the most of your finances while helping you find exactly what you need. And don’t forget that there is always the Canada Greener Homes Grant available! Reach out to a member of our team today to get started in planning the renovation you deserve!

1000’s of Colours & Textured Finishes

Transform your home from ordinary to extraordinary with our new coloured and non-glare textured finishes. Available in a wide array of colours as well as custom matched colours for your very own personalized design.

Our Most Popular Replacement Window Colours: